Coming up with the ideal small business employee remuneration plan and benefits package can make a huge difference when it comes to attracting and retaining talented employees for your business. From statutory minimum wage requirements to benefits packages, here’s what you need to know to get going.

Employee Remuneration

Apart from developing a pay matrix for each position there is a lot more to consider for the small business owner.

As a small business owner, you’ll want to find simpler ways of calculating and paying salaries without taking up much of your precious time. There is need to comply with all employment related regulations governing businesses. It is also important to craft a benefits package that attracts and retains talent in your business.

How should you go about in designing a remuneration plan? Here are some of the things you need to look at;

Minimum Wages: Prescribed wages that you should be paying your Employees

Minimum wages are pay scales that are set by National Employment Councils that bring together employers, labour and government. The minimum wages give you a starting point in coming up with your own pay matrix. You may not pay wages that are below the set NEC minimums for each position.

It is therefore important that you know which National Employment Council (NEC) your business falls under because pay scales differ for the different industries.

Designing your Employee Remuneration Plan

Once you determine the minimum wage requirements in your industry sector, you need to come up with an employee remuneration plan tailored for your business. There is no one size fits all remuneration plan, what is right for one company may not apply for another. Moreover, you would want to come up with your own unique plan that addresses your business needs to attract and retain talent as well as enhance competitiveness. Goals and needs of your business should be the guiding factor when coming up with a remuneration plan.

The most common types of remuneration plans include:

- A basic salary determined for each job title or position (may include a range with a minimum and maximum to accommodate for promotions)

- Basic salary plus commission for employees who are encouraged to make sales and reach goals, but still receive base pay

- Commission-only remuneration plans for sales people who must perform in order to get paid

From your experience and industry knowledge, you most probably know the standard remuneration scales in your industry. For example, while a retail shop may offer a commission to entice sales employees, this same model may not apply for a small fast-food restaurant.

If you’re not sure, you can consult the NEC for your industry and other resources such as Salary Survey reports produced by Human Resources Consultants and Employment Agents to find out what typically works best in your particular industry. It will help you make sure what you’re offering is competitive.

How Do You Calculate Remuneration?

There is no exact science to calculating employee remuneration, but again, research can help you determine the median salary of people working in the same or similar roles at other companies.

You need to come up with the maximum amount you can afford to pay for each job position. Set rates that you are comfortable with and be guided accordingly by your business cash flows and budget. You also need to value each role in your business. You may need to raise remuneration levels for key roles in order to attract and retain the right employees.

Next, you need to figure out the minimum salaries so that you remain competitive. The statutory minimums set by your industry NEC may no longer be competitive in the market owing to inflationary factors. You therefore need to be well researched and up-to-date with remuneration trends in your industry in order not to lag behind.

Coming up with employee benefits

There are a few employee benefits that you are required to provide by labour laws:

- National Social Security Authority (NSSA) contributions, namely Pensions and Other Benefits Scheme (POBS) and Accident Preventions and Workers Compensation (APWC) contributions.

- Leave benefits, as stipulated in labour laws

Benefits such as health insurance (Medical Aid) and funeral assurance are optional but may be key in attracting and retaining good employees. Other benefits can include items such as staff discounts on purchase of your business’s merchandise, subsidized meals or staff canteens and staff transport among many others.

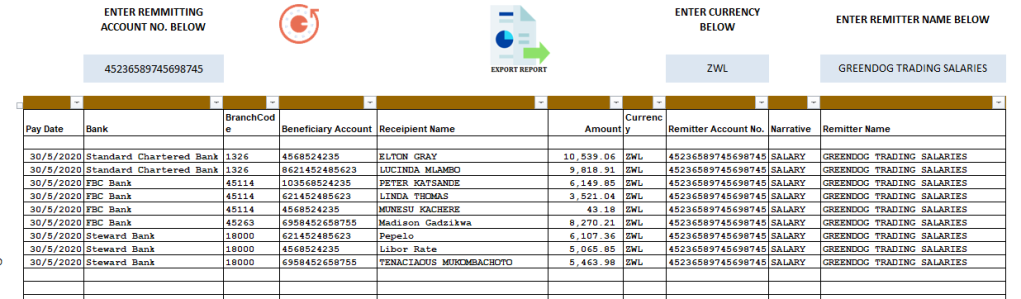

How Do Small Businesses Pay Employees?

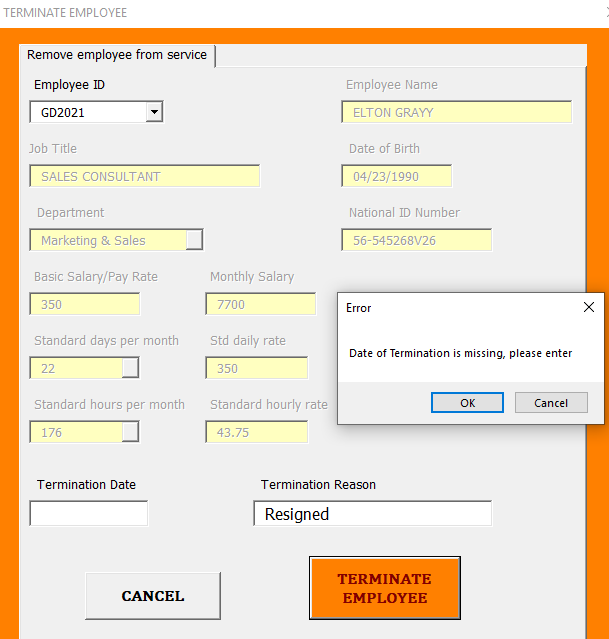

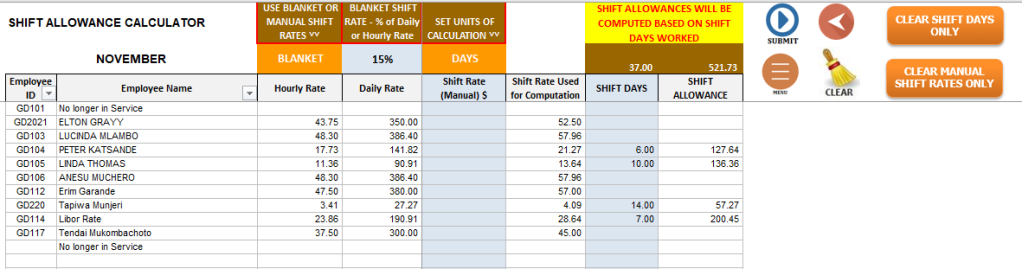

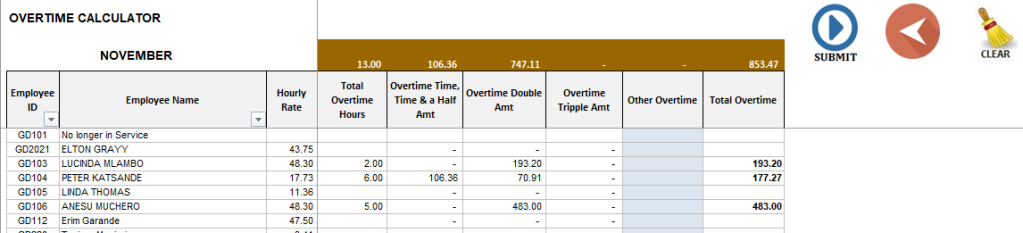

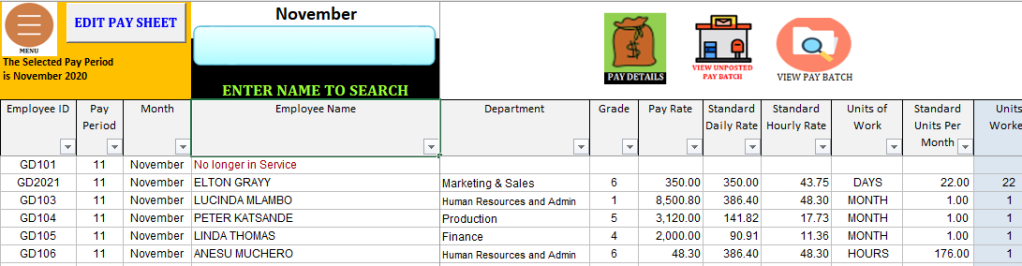

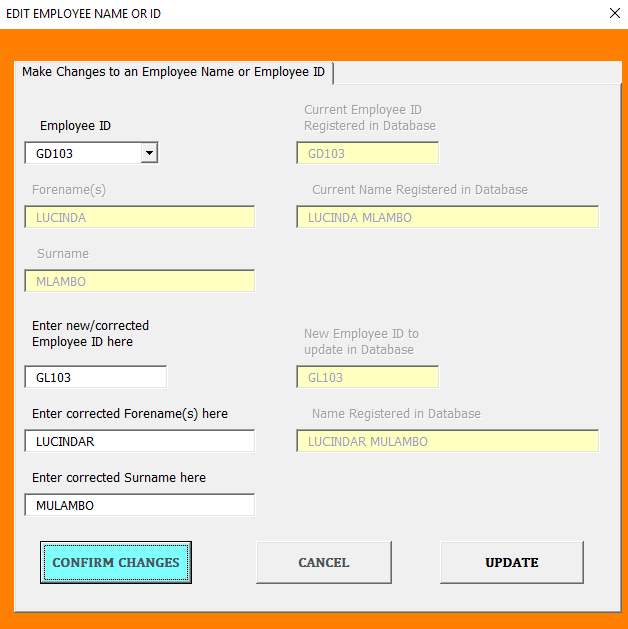

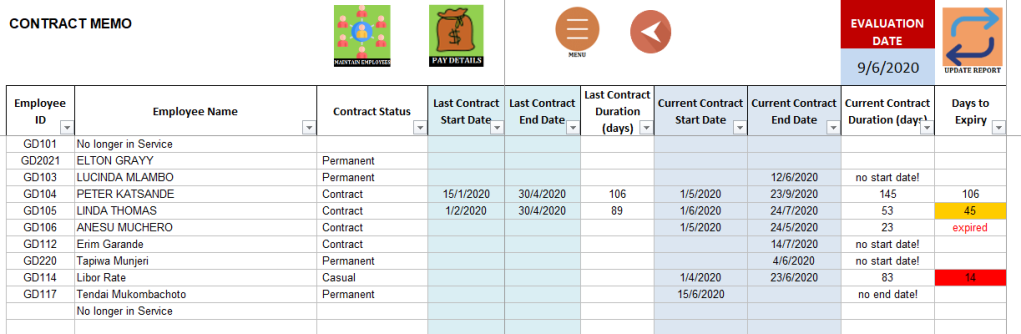

The final piece of the employee remuneration puzzle is how you will actually calculate and issue out salary payments and pay slips to your employees. You will acknowledge that the take home salary paid out to employees in not equal to the gross salary. Payroll taxes and other deductions need to be accounted for before coming up with the final net salary payable. It therefore follows that a business should have a system for calculating salaries. A lot of small businesses make use of manual excel spreadsheets to compute salaries but these tend to cumbersome and difficult to administer. It is highly recommended that you adopt a payroll system to help you automate salary computations and produce various payroll reports. Find out more about how Izzypayroll can help you simplify payroll computations and administration for your small business.

You may also read the following article outlining why your business needs a Payroll System; Payroll Management in small businesses